Originally posted in The Daily Star on 25 May 2022

It would be quite unfortunate if Bangladesh needs to import cheap renewable energy from neighbouring countries and export the electricity generated from expensive fossil fuels by bearing the burden of the capacity payment and the huge import bill

On April 26, State Minister for Power, Energy and Mineral Resources Nasrul Hamid met with a Nepali delegation led by Pampha Bhusal, the energy, water resources and irrigation minister of the country.

According to a press release on the meeting, Hamid announced that Bangladesh and Nepal could consider bilateral trade of electricity where Bangladesh could export its surplus electricity to Nepal to meet its deficit in electricity and could import electricity from Nepal generated by hydroelectric projects during the summer season.

The proposal apparently indicates a good example of regional energy cooperation between Bangladesh and Nepal in partnership with India where the latter’s transmission system needs to be used. However, the proposal needs further scrutiny to better understand the nature of energy cooperation between Bangladesh and Nepal and the level of partnership with India in this regard.

Nepal’s options for cross-border energy trade

Nepal has recently turned to be in a state of energy surplus after it has long been an energy-deficient country. According to the White Paper 2018 of Nepal, Nepal had an electricity deficit of 377 megawatts.

However, after initiating the operation of the Upper Tamakoshi Hydropower Project (456 MW) in 2021, Nepal has now a surplus power of 500MW even during the peak time. Its total generation capacity stands at 2,000 MW, of which 1,900 MW, or 95 per cent of the total, is based on hydro-power.

Nepal has already started trading a part of its surplus electricity (39 MW out of 500 MW) with the Indian energy exchange and is now pursuing exporting a part of its surplus electricity to a third country such as Bangladesh.

The amount of surplus electricity will rise further if Nepal becomes successful in making necessary investments to reach its target of additional power generation of 5,000 MW by 2025 and 15,000 MW by 2030. Thus, the case of Nepal to explore the third country to trade its surplus electricity has a valid reason. Under such circumstances, it is not sure whether Nepal would experience a deficit in power supply in the future. If not, the possibility for Bangladesh to explore the opportunity to export its surplus electricity to Nepal would be rather low.

Partnership with India in cross-border electricity trade between Bangladesh and Nepal

Being a land-locked country, Nepal’s plan to export its electricity other than India requires India’s close cooperation and partnership. According to the Central Electricity Regulatory Commission of India, the Indian authority is allowed to do cross-border trade where India is involved.

There is a specific provision of a tripartite agreement that allows the Indian authority to sign the framework of bilateral agreements between the government of India and the governments of the respective neighbouring countries. In other words, Bangladesh and Nepal need to sign bilateral agreements for cross-border electricity trade with India.

Bangladesh’s options for cross-border energy trade

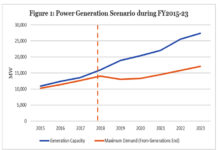

Bangladesh has an installed generation capacity of 25,556 MW from where about 13,079 MW of electricity has been generated. According to the April 30 report of the Bangladesh Power Development Board (BPDB), there is an unutilised capacity of 12,477 MW, which is as high as 48.8 per cent of the total installed capacity.

The amount of excess capacity usually rises further during the winter season, which amounted to be 52.8 per cent in November 2021. Apparently, such an excess reserve margin in generation capacity is likely to be a source for cross-border energy trade. It is important to note here that Bangladesh’s plan to export electricity should not be based on its excess reserve margin, which is causing huge fiscal and budgetary pressure on the economy.

Maintaining more than 48 per cent of excess capacity requires paying capacity payment to the private sector. Although the average retail price of electricity is Tk 6.81 per kilowatt-hour, the generation cost of some independent power producers and quick rental power plants after paying the capacity payment reached as high as Tk 300 ($3.45) and Tk 600 ($6.95) per unit, respectively.

Because of the administered price of electricity, such high generation costs have been accommodated by allocating subsidies from the public exchequer. Since FY2017, the government has allocated a subsidy of Tk 32,000 crore to mainly meet the capacity payment.

According to the data of September 2021, because of subsidising the electricity generation, the retail electricity price for commercial use in Bangladesh is Tk 8.99 ($0.104) while in Nepal, it was 9.010 Nepalese rupee ($0.074). Thus, Bangladesh’s retail price is higher than that of Nepal.

Without the subsidy, Bangladesh may not offer a competitive price to Nepal. The point is: Will BPDB export electricity to Nepal or any other country at the subsidised price taking the burden of huge fiscal burden?

At present, more than 90 per cent of total electricity is generated by using domestic natural gas (52 per cent), imported liquefied natural gas or LNG (13 per cent), petroleum (36 per cent) and coal (3 per cent). The use of renewable energy is minimal – only 3 per cent.

With the depletion of domestic natural gas, the dependency on imported fossil fuels, both LNG and petroleum, is increasing. The government has spent $5.4 billion to import crude petroleum, petroleum products, coal and LNG in 2021, while the import cost of energy was $2.8 billion in FY2016.

The import bill for the purchase of energy would rise much higher in the ongoing fiscal year since the Ukraine war has sent the energy prices higher. Such a huge import bill has created huge pressure on the exchequer and the pressure would intensify in the coming years unless the energy mix is restructured by using more renewable energy. Hence, Bangladesh should not facilitate fossil fuel-based electricity for cross-border trading.

Feasible options for Bangladesh’s cross-border energy trade

Bangladesh’s future scope for regional electricity trade needs a major overhauling in its energy mix in order to achieve its target (40 per cent of the total power by renewable energy by 2041). It needs to significantly reduce its excess capacity and keep the installed capacity with a modest reserve margin.

Without phasing out the excess installed capacity of fossil fuel-based power plants, it is difficult to promote renewable energy-based power generation. Most of the quick rental power plants are supposed to be closed down by 2024 and should not be extended beyond that.

Alternatively, Bangladesh will have to depend on the neighbouring countries to meet the target of 40 per cent of renewable energy through the import of renewable energy from India, Nepal and Bhutan.

It would be quite unfortunate if Bangladesh needs to import cheap renewable energy from neighbouring countries and export the electricity generated from expensive fossil fuels by bearing the burden of the capacity payment and the huge import bill. Bangladesh should prioritise developing a domestic base of renewable energy, cutting reliance on regional countries.

Exploring feasible options through the proposed master plan

Bangladesh’s new power and energy policy, the Integrated Power and Energy System Master Plan, should promote developing a domestic base of energy, primarily focusing on renewable energy. Besides, the new plan should not put over-emphasis on cross-border trade of electricity.

Bangladesh has the little luxury to export electricity at subsidised prices. And there is no logic to keep these power plants alive with the argument of exporting electricity.

The author is research director of the Centre for Policy Dialogue.