The electricity purchased from IPPs accounts for more than 50% of the Bangladesh Power Development Board’s total operating expenses

Originally posted in The Business Standard on 11 February 2022

The rising cost of electricity sold by independent power producers (IPPs) and payments for keeping overcapacity in the system can result in increased power tariffs in Bangladesh, says a new report by the Institute for Energy Economics and Financial Analysis (IEEFA).

The electricity purchased from IPPs accounts for more than 50% of the Bangladesh Power Development Board’s total operating expenses.

The IEEFA, in its report, recommended Bangladesh to focus on grid investment and renewable sources rather than switching from imported coal to imported liquified natural gas (LNG).

A hike in tariffs, however, has been on the cards for a while.

Earlier in January, the Bangladesh Power Development Board (BPDB), in a proposal to the Bangladesh Energy Regulatory Commission (BERC) asked for a bulk power tariff increase of up to 64% to meet the increasing cost of power generation and purchases of imported coal, LNG and oil.

According to BPDB data, in the 2020-21 fiscal year, the agency spent a total of Tk50,435crore to generate and purchase electricity from IPPs, rental and public plants, and in imports from India.

Of this, Tk27,737crore was spent on electricity from IPPs, an increase from Tk17,519crore in 2019-2020.

The significant rise in the cost of electricity purchases from IPPs has become a big reason for the government subsidies to bail out the BPDB after its losses reached a record Tk11,780crore in the 2020-21 fiscal year, up from Tk7,440 crore in the prior year.

At the same time, overcapacity is eroding the BPDB’s financial status. Capacity payments reportedly increased to Tk13,200crore in the 2020-21 fiscal year.

This correspondent called the BPDB chairman a number of times, but he could not be reached for comments.

Capacity utilisation may drop to just 38%

With larger coal IPPs under construction and large capacities of LNG-fired projects planned, the BPDB’s IPP cost is likely to increase significantly, said the IEEFA.

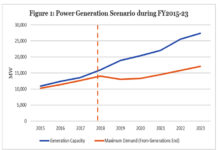

According to the BPDB’s latest annual report, 12,967 megawatts (MW) will be added to the grid after construction of a new plant and another 19,651MW is expected by the end of 2024-2025 fiscal year.

Over the same period, only 3,990MW of old capacity is planned to be retired, according to the BPDB.

As a result of the large capacity additions, the overall power plant utilisation will drop to just 38% by 2024-2025 even if the power generation grows at a very high 12%.

The BPDB’s losses may also increase spending on subsidies.

New power master plan can bring relief

The new Integrated Energy and Power Master Plan (IEPMP), funded by the Japan International Cooperation Agency represents an opportunity for Bangladesh to halt the construction of planned LNG and coal power plants and reset the planning to provide a financially sustainable power system for the long term.

The master plan focuses more on renewable sources of power.

“Building domestic low cost clean energy capacity would help improve the eroding financial status of the Bangladesh Power Development Board (BPDB) which is burdened by the country’s capacity over-expansion based on imported fossil fuels,” said Energy analyst and author of the IEEFA report Simon Nicholas.

“Any further focus on imported volatile fossil fuels is a warning to energy consumers in Bangladesh. Further significant and economically damaging power tariff growth is more than likely.

“The new power system master plan led by JICA should not call for increased imports of fossil fuels, which will further damage tariffs.

“Bangladesh energy consumers are at risk of being asked to pay massive tariff increases to cover shortfalls being experienced by the BPDB. This is not sustainable, and does not address the root of the problem in the power sector.”

Bangladesh has already suffered from exposure to the price-volatile global LNG market. The cost of liquified natural gas (LNG) soared to record highs in 2021, forcing Bangladesh to pay record prices. Analysts don’t expect stability in the market any time soon.

Nicholas wrote that the higher renewable energy ambition of SREDA and the Mujib Climate Prosperity Plan must be reflected in the new energy and power master plan.

“If Bangladesh wishes to start enjoying the benefits of low-cost renewable energy as much of the rest of the world is, the government’s ambitious wind and solar targets need to be locked into the new IEPMP.”